What are my legal obligations as an Australian small business owner?

This guide will help you navigate the legal landscape that every Australian small business owner must understand. As you initiate on or continue your entrepreneurial journey, it’s necessary to be aware of your various responsibilities, including tax obligations, employment laws, and consumer protection regulations. By familiarizing yourself with these legal requirements, you can ensure that your business operates smoothly and stays compliant, reducing the risk of potential legal challenges down the road. Let’s explore the key obligations that apply to your business operations.

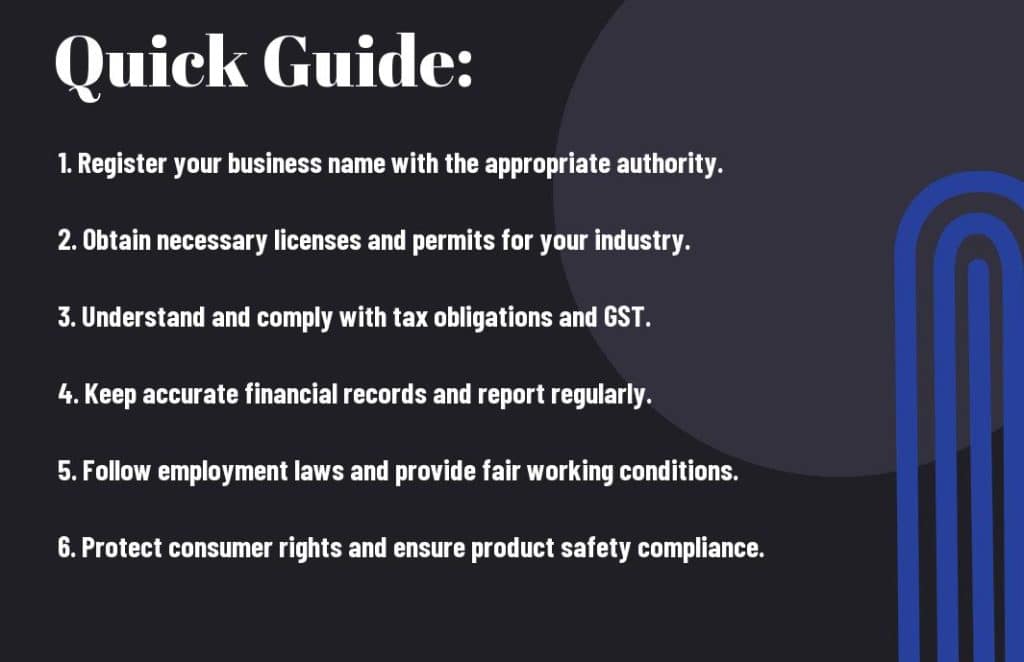

Key Takeaways:

- Compliance with laws: Ensure adherence to federal, state, and local regulations that affect your business operations, such as taxation, employment, and consumer protection laws.

- Licenses and permits: Obtain all necessary licenses and permits specific to your industry and location to legally operate your business.

- Record keeping: Maintain accurate financial and business records, including tax documents and employee information, to comply with legal requirements and facilitate audits.

Understanding Your Legal Obligations

Your legal obligations as an Australian small business owner encompass various regulatory requirements that ensure your business operates within the law. These obligations can vary based on many factors, including your business structure, industry, and location. Familiarising yourself with these requirements is necessary to avoid penalties and foster a sustainable business environment.

Types of Business Structures

Your choice of business structure significantly impacts your legal obligations. Below are the most common types:

- Sole Trader

- Partnership

- Company

- Trust

- Cooperative

Knowing your business structure will help you navigate the associated legal responsibilities effectively.

| Business Structure | Legal Obligations |

|---|---|

| Sole Trader | Register for an ABN and meet tax obligations. |

| Partnership | Set up a partnership agreement and manage shared tax responsibilities. |

| Company | Register with ASIC, maintain company records, and adhere to corporate laws. |

| Trust | Set up a trust deed and meet specific tax obligations. |

| Cooperative | Comply with cooperative laws and governance requirements. |

Compliance Requirements

Business obligations extend to compliance requirements that you must fulfill to operate legally. These often include tax registration, obtaining necessary licenses, and adhering to local regulations.

Types of compliance requirements vary by industry, so it’s important to research the specific rules applicable to your business. This may involve occupational health and safety standards, employment laws, and environmental obligations. Non-compliance can incur significant fines, impacting your business reputation and profitability, making it imperative for you to stay informed and proactive about all relevant regulations.

Essential Legal Documents

Now that you are aware of your obligations, it’s important to get your necessary legal documents in order. These documents help protect your business interests and establish clear communication with clients and suppliers. Having well-prepared legal documents can prevent misunderstandings and ensure that your business operations run smoothly.

Contracts and Agreements

The foundation of any successful business operation is a solid set of contracts and agreements. These legal documents outline the terms of your relationships with clients, suppliers, and employees. You should ensure that all agreements are clear and precise to minimize the risk of disputes and misunderstandings down the line.

Licenses and Permits

For your business to operate legally in Australia, you must secure the appropriate licenses and permits relevant to your industry. Different sectors have varying requirements, so it’s necessary to research which licenses you need based on your business activities and location.

Legal compliance regarding licenses and permits not only protects your business but also enhances your credibility in the market. Local, state, and federal regulations may require specific permits for operating your business, such as health and safety permits or environmental licenses. Investing time to understand and obtain these necessary approvals can prevent costly fines and interruptions to your business operations.

Tax Responsibilities

All Australian small business owners must navigate various tax obligations to ensure compliance with the law. You will need to be aware of your tax responsibilities, including understanding your tax registration requirements and filing dates. Ensuring your business meets these obligations not only helps you avoid penalties but also fosters responsible financial management within your business.

Types of Business Taxes

All businesses are subject to different forms of taxation. You should be familiar with the following types:

- Goods and Services Tax (GST)

- Income Tax

- Fringe Benefits Tax (FBT)

- Pay As You Go (PAYG) Withholding Tax

- Payroll Tax

After understanding these types, you can better navigate your obligations.

| Tax Type | Description |

| GST | A tax on goods and services sold. |

| Income Tax | Tax on the income generated by your business. |

| FBT | Tax on non-cash benefits provided to employees. |

| PAYG | Tax withheld from employee wages. |

| Payroll Tax | A tax on the total payroll of your business. |

Record-Keeping Tips

One of the most important aspects of managing your business finances is maintaining accurate records. You should implement effective record-keeping practices to help you track your income and expenses. This not only aids in tax compliance but also provides valuable insights into your business performance.

- Use accounting software for organized tracking.

- Keep receipts and invoices for all transactions.

- Regularly back up your data to prevent loss.

- Review your records monthly to identify trends.

- Consult with a tax professional for advice.

This will ensure you are well-prepared for tax season and audits.

The importance of systematic record-keeping cannot be overstated. You need to ensure that your financial documents are clear, consistent, and accessible. This will not only help you during tax time but also enable you to make informed business decisions based on your financial status.

- Organize files by category for easy access.

- Maintain digital records alongside physical copies.

- Designate a specific time each week for record updates.

- Stay informed of record-keeping regulations.

- Seek assistance if you’re overwhelmed by the process.

This diligence contributes significantly to the overall health and success of your business.

Employee Relations

Not understanding your obligations surrounding employee relations can lead to significant issues for your small business. As an owner, you are responsible for fostering a fair and compliant workplace, which involves adhering to various employment laws, ensuring workplace health and safety standards, and maintaining healthy communication with your employees. Knowledge of these obligations can help you create a positive and productive environment.

Employment Laws

An integral part of managing your small business is familiarizing yourself with employment laws. This includes understanding employee rights, minimum wage requirements, leave entitlements, and unfair dismissal laws. Ensuring compliance not only protects your business from potential legal disputes but also fosters trust and respect within your team.

Workplace Health and Safety

Safety in your workplace is imperative for the well-being of you and your employees. You must comply with the Workplace Health and Safety Act, which mandates that you provide a safe working environment. This includes identifying potential hazards, offering appropriate training, and implementing safety protocols.

Plus, prioritizing workplace health and safety means you’ll reduce the risk of accidents and injuries, which can result in costly compensation claims and downtime. Regular risk assessments and employee training sessions are vital in creating a culture of safety. Remain proactive about safety measures, ensuring that your employees are aware of procedures and can report concerns without hesitation.

Factors Influencing Legal Compliance

For small business owners in Australia, understanding the legal landscape can be challenging. Several factors can influence your ability to maintain compliance, including:

- Your industry type

- Local government regulations

- The size and structure of your business

- Ongoing legislative changes

The more you stay informed about these factors, the better prepared you will be to navigate your legal obligations.

Industry-Specific Regulations

Now, it’s important to recognize that different industries come with unique regulatory requirements. Each sector—whether it’s retail, hospitality, or healthcare—has specific laws governing everything from product safety to employee rights. Ensuring compliance in your particular field will help you operate smoothly and avoid any legal risks.

Regional Legislation

One key aspect that you should focus on is regional legislation, which can vary significantly across different states and territories in Australia. Local laws may impose additional duties or requirements that go beyond national regulations. Understanding these can help you prevent legal complications and better serve your community.

Understanding the regional legislation affecting your business is crucial for compliance. Each state and territory may have unique laws that relate to environmental protections, zoning, employee rights, and consumer protection. It is advisable to familiarize yourself with local regulations and consult with legal professionals when necessary. This proactive approach enables you to navigate any potential legal pitfalls effectively and position your business for success in your specific area.

Pros and Cons of Legal Compliance

Many small business owners weigh the pros and cons of legal compliance as they navigate their responsibilities. Understanding these factors can help you make informed decisions that ultimately affect your business’s growth and sustainability.

| Pros | Cons |

|---|---|

| Builds customer trust and credibility | May require time and financial resources |

| Reduces risk of legal penalties | Can be complex and overwhelming |

| Creates a safer working environment | Compliance costs may affect profitability |

| Enhances market competitiveness | Constant updates may be needed as laws change |

| Improves business reputation | May require hiring legal or compliance expertise |

Benefits of Adhering to Regulations

Clearly, adhering to regulations not only protects your business from potential legal issues but also fosters trust among your customers and stakeholders. By demonstrating your commitment to lawful practices, you enhance your brand’s reputation and increase customer loyalty, which can lead to long-term success.

Risks of Non-Compliance

Clearly, non-compliance can expose you to significant risks that can jeopardize your business. The potential for fines, legal action, and damage to your reputation can have long-lasting impacts, making it vital to understand and meet your legal obligations.

It’s important to acknowledge that the consequences of non-compliance can escalate quickly. In addition to financial penalties, your business may face lawsuits, revocation of licenses, or even criminal charges in severe cases. These repercussions can not only harm your business operations but also affect your personal finances and livelihood. Adhering to legal requirements is not just a matter of following rules; it’s an investment in your company’s future stability and growth.

Summing up

To wrap up, as an Australian small business owner, you have several legal obligations encompassing registration, taxation, employment laws, and consumer protections. You must ensure compliance with the Australian Securities and Investments Commission (ASIC) and Australian Competition and Consumer Commission (ACCC) regulations, while also adhering to workplace safety standards set by Safe Work Australia. Keeping accurate records and understanding your responsibilities regarding GST and other taxes is important. By staying informed and proactive, you can successfully navigate the legal landscape that governs your business operations.

Q: What types of licenses and permits do I need to operate my small business in Australia?

A: The licenses and permits required to operate a small business can vary significantly depending on your industry, location, and the nature of your business activities. Typically, you may need to register your business name, obtain an Australian Business Number (ABN), and possibly apply for specific industry licenses or permits. For example, businesses in sectors such as food services, health, construction, and education often require additional certifications. It’s important to check with your local council and the Australian Business License and Information Service (ABLIS) to ensure you have the necessary permits to comply with legal requirements.

Q: What are my obligations regarding taxes and record-keeping as a small business owner?

A: As a small business owner in Australia, you must comply with various tax obligations, including income tax, Goods and Services Tax (GST) if your turnover exceeds the GST threshold, and potentially payroll taxes if you employ staff. It is important to keep accurate and up-to-date records of all financial transactions, including sales, expenses, and employee wages. This helps ensure you’re meeting your tax obligations and can assist in any audits that may occur. Additionally, using accounting software can help streamline your record-keeping and keep track of deadlines for tax submissions.

Q: What employee rights do I need to be aware of as an employer?

A: As an employer in Australia, you are obligated to comply with the Fair Work Act, which outlines employee rights, including minimum wage, working hours, leave entitlements, and safe working conditions. You must ensure your employees receive their correct pay rates, access to entitlements such as annual leave and sick leave, and are not subjected to unfair treatment or discrimination in the workplace. Providing a written contract for each employee that details their roles, responsibilities, and conditions of employment is also recommended. It’s advisable to stay informed about changes in employment laws and regulations that may affect your obligations toward your workforce.